Our rates & indexes

Eagle Life product rates

Powerful index options and strong partnerships

A variety of crediting strategies through our available indexes allow you to diversify your retirement dollars and provide the opportunity to benefit from index increases while your principal remains protected from market downturn.

Consists of 500 leading U.S. stocks, and is a common benchmark of the U.S. stock market. The S&P® 500 Index is widely regarded as the single best gauge of large-cap U.S. equities.

The S&P 500 Advantage 15% VT TCA Index applies an intraday risk control mechanism to provide exposure to the S&P 500 while targeting a 15% volatility level. The index rebalances through the trading day based on volatility observed in seven intraday windows and estimates of future market movements based on hypothetical option prices. The index seeks to take advantage of changing market conditions during the day by adjusting equity exposure up or down and includes a transaction cost adjustment (TCA).

Volatility control index that consists of S&P 500® members that have consistently increased dividends every year for at least 25 consecutive years. This index is designed to provide added stability by limiting risk exposure and measuring the market performance on a daily basis using the most consistent, dividend-producing companies on the S&P 500® Index.

Index that focuses on growth and seeks to optimize performance by dynamically combining U.S. equities and bonds, and matching allocation strategies to one of four economic cycles — recovery, expansion, slowdown or contraction. Addresses risk by monitoring market performance and making intra-day allocation adjustments as needed.

The Invesco QQQ 15 Index is a growth-oriented index featuring Invesco’s QQQ ETF. It combines QQQ, an innovation-focused ETF, with a volatility targeting approach aimed at maximizing growth potential via equities while maintaining an annual volatility level of 15%.

Designed to deliver exposure to the iShares® Core S&P 500® ETF, this index is subject to a 5% target volatility that incorporates its U.S. Treasury iShares® ETF and cash components with the ability to rebalance daily.

Designed to deliver exposure to the iShares® Core S&P 500® ETF, this index is subject to a 7% target volatility that incorporates its U.S. Treasury iShares® ETF and cash components with the ability to rebalance daily.

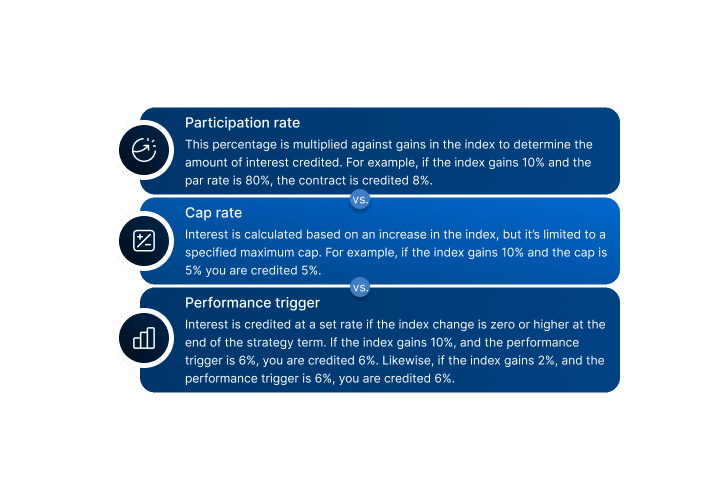

Crediting strategies: Par vs. cap vs. trigger

These crediting strategies are the primary methods available with a FIA. Potential interest is calculated by applying the crediting strategy to your linked index or indexes. With all crediting strategies, you’ll earn interest when the index increases but you won’t lose any value if it decreases.

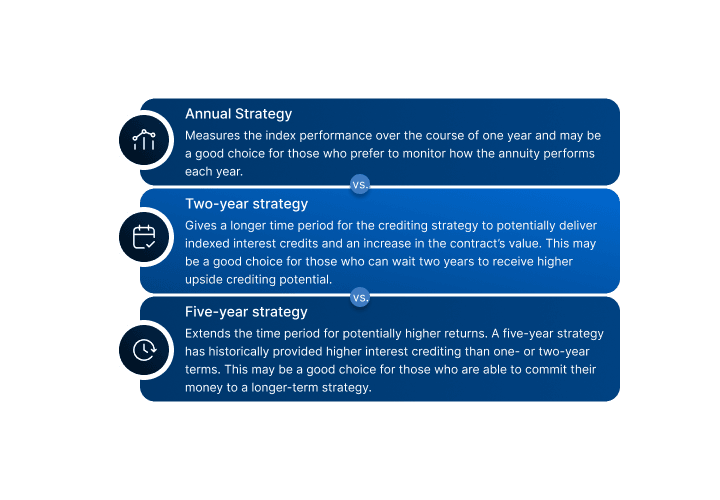

Crediting timeframes: Annual vs. two-year vs. five-year

Once the crediting strategy is determined for an index, the next step is to choose how often interest gets credited. You determine index performance by comparing the index’s value on the first day of the indexing time period to its value on the last day (point-to-point).

Not all crediting strategies are available on all indices.

Annuity contract and rider issued under form series ICC23 E-BASE-IDX, ICC23 E-IDX-C-7, ICC23 E-IDX-C-5, ICC22 E-E-PTP-CL, ICC23 E-E-PTP-RL, ICC21 E-E-PTP-C, ICC21 E-E-PTP-PR , ICC17 E-R-MVA, ICC21 E-R-ERR, ICC20 E-R-EBR, and state variations thereof. Availability may vary by state. For complete details, please see product-specific sales brochure(s) and disclosure(s).

Past performance is no indication of future results. If the sum of all Performance Rate Rider charges deducted is greater than all interest credited to the contract value at the end of the surrender charge period, we will increase the contract value by the difference.

Surrender charges may apply to excess withdrawals that, in addition to LIB payment, exceed 10% annual free withdrawal available under the contract. You may be subject to a 10% federal penalty if you make withdrawals before age 59½. Withdrawals are subject to ordinary income tax.

Market Value Adjustment (MVA) applies to partial withdrawals that exceed the free withdrawal amount allowed and surrenders occurring during the surrender charge period.

Enhanced Benefit Rider (ICC20 E-R-EBR) included with no fee for issue ages 75 and under. Availability and benefits may vary by state. Not available in CA.

Possible interest credits for money allocated to an index-linked crediting strategy are based upon performance of the specific index; however, fixed index annuities (FIAs) are not an investment, but an insurance product, and do not directly invest in the stock market or the index itself.

This is not a comprehensive overview of all the relevant features and benefits of the Eagle Select® Focus 5 or Eagle Select® Focus 7 FIAs. Please read the sales brochure and disclosure for complete details and limitations.

This material is for informational purposes only, and is not a recommendation to buy, sell, hold or rollover any asset. It does not take into account the specific financial circumstances, investment objectives, risk tolerance or need of any specific person. In providing this information, Eagle Life Insurance Company® is not acting as your fiduciary as defined by the Department of Labor. Eagle Life does not offer legal, investment or tax advice or make recommendations regarding insurance or investment products. Please consult a qualified professional.

Guarantees are based on the financial strength and claims-paying ability of the issuing company. Eagle Life is a wholly owned subsidiary of American Equity Investment Life Insurance Company®.

The BlackRock® Adaptive U.S. Equity 7% Index and the BlackRock® Adaptive U.S. Equity 5% Index (the “Indexes”) are products of BlackRock Index Services, LLC and have been licensed for use by Eagle Life Insurance Company as components of Eagle Life fixed index annuities (the “Products”). BlackRock®, BlackRock® Adaptive U.S. Equity 7% Index,, BlackRock® Adaptive U.S. Equity 5% Index and the corresponding logos are registered and unregistered trademarks of BlackRock. The Products are not sponsored, endorsed, sold or promoted by BlackRock Index Services, LLC, BlackRock, Inc., or any of its affiliates, or any of their respective third-party licensors (including the Index calculation agent, as applicable) (collectively, “BlackRock”). BlackRock has no obligation or liability in connection with the administration or marketing of the Products. BlackRock makes no representation or warranty, express or implied, to the owners of the Products or any member of the public regarding the advisability of investing the Products or the ability of the Indexes to track general market performance. BlackRock does not guarantee the adequacy, accuracy, timeliness, and/or completeness of the Indexes or any data or communication related thereto nor does it have any liability for any errors, omissions or interruptions of the Indexes.

Invesco Indexing LLC (“Licensor”) has licensed the Indexes to Eagle Life Insurance Company to be used as a component of certain fixed index annuity products (the “Products”). The Indexes may be calculated by a third party or contain third-party data, each third-party provider and Licensor are collectively “Licensor Parties”. The Products are not sponsored, operated, endorsed, sold or promoted by Licensor Parties. The Indexes, the proprietary data therein, and related trademarks, are intellectual property licensed from Licensor, and may not be copied, used, or distributed without Licensor’s prior written approval. The Products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by Licensor Parties. Licensor Parties make no express or implied warranties, and hereby expressly disclaims all warranties of merchantability or fitness for a particular purpose with respect to the Indexes or any data included therein. Without limiting any of the foregoing, in no event shall Licensor Parties have any liability for any special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.

Nasdaq-100® and QQQ® are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Eagle Life Insurance Company. The Product(s) have not been passed on by the Corporations as to their legality or suitability. The Product(s) are not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the Product(s).

The S&P 500 and the S&P 500 Dividend Aristocrats Daily Risk Control 5% ER Index are products of S&P Dow Jones indices LLC or its affiliates (“SPDJI)”, and the S&P 500 Advantage 15% VT TCA Index (USD) ER, a product of SPDJI and BofA Securities, Inc. (collectively, the “Indices“), and have been licensed for use by Eagle Life Insurance Company® (“Eagle Life”). S&P®, S&P 500®, US 500™, The 500™, Dividend Aristocrats® are trademarks of S&P Global, Inc. or its affiliates (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and have been licensed for certain purposes by Eagle Life. Eagle Life’s insurance products based on the Indices are not sponsored or sold by SPDJI, Dow Jones, S&P, their respective affiliates, or BofA Securities, Inc. and none of such parties makes any representation regarding the advisability of investing in such products, nor do they have any liability for any errors, omissions, or interruptions of the Indices.

| Not FDIC/NUCA Insured | May Lose Value | No Bank/Credit Union Guarantee | Not a Deposit | Not Insured by any Federal Government Agency |