American Equity of New York

American Equity Investment Life Insurance Company of New York is an annuity provider specializing in safe, innovative retirement options, helping our clients plan for a secure financial future with their hard-earned dollars.

American Equity of New York is committed to providing fixed annuity products with integrity, which includes its distinctive line of annuities that are offered through broker dealers and financial institutions.

The American Equity of New York Story

American Equity of New York is a wholly-owned subsidiary of American Equity Investment Life Insurance Company® and sister company of Eagle Life Insurance Company®. American Equity takes pride in being an American-owned and operated company.

What helps us stand out from the competition is a deep-rooted commitment to conservative investment practices to keep finances secure, as well as customer service that goes above and beyond expectations for broker dealers, financial institutions, representatives and their clients.

We take pride in employing professional and helpful team members who can assist you with your individual contract needs. Since day one, the company has remained dedicated to providing excellent customer service and has a service team committed to helping clients with their annuity questions.

American Equity of New York is also committed to innovation and finding more efficient ways to do business to meet the needs of an evolving industry and the financial institutions and the customers we serve.

Whether it’s advancements in technology or going above and beyond to meet the needs of our customers, American Equity of New York remains driven to develop innovative and competitive products.

How Do Fixed Annuities Work?

As pre-retirees look for tax-deferred options for retirement assets, fixed annuities can be a lifetime income product as part of their overall retirement income plan. A fixed annuity is an insurance product and is a contract between the contract holder and insurance company.

Interest accumulates based on a fixed interest rate, which is set at the beginning of the contract. The fixed interest rate is guaranteed for a set period of time.

American Equity of New York’s fixed annuities can help provide numerous benefits for people seeking practical retirement options. These benefits include growth potential, tax deferral and principal protection with all premiums.

Since every retirement journey varies to fit people’s individual financial strategy, we aim to provide our customers with fixed annuities designed with simplicity, flexibility, stability and longevity to help with their unique retirement needs. We look forward to assisting you with your long-term retirement goals and financial future.

Retirement Trends

People are living longer, staying more active and wanting to have the same quality of lifestyle in retirement that they grew accustomed to in their professional career.

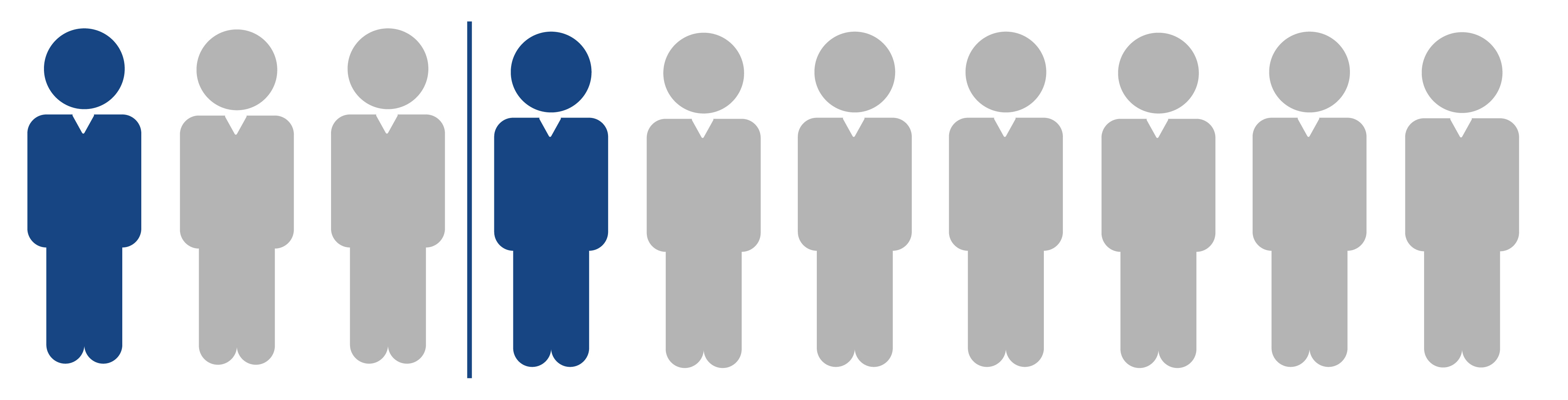

According to the Social Security Administration, approximately one out of every three 65-year-olds today will live past age 90, and about one out of seven will live past age 95.

According to the Social Security Administration, approximately one out of every three 65-year-olds today will live past age 90, and about one out of seven will live past age 95.

With people having approximately 30 years in the retirement phase of their life, retirees want to enjoy their golden years, which could mean traveling across the country or moving closer to family.

To avoid harsh winters, retirees might also consider downsizing and spending those cold months in states with warmer climates. With more free time on their hands, retirees could also express an interest in starting a new hobby, business or exercise regimen.

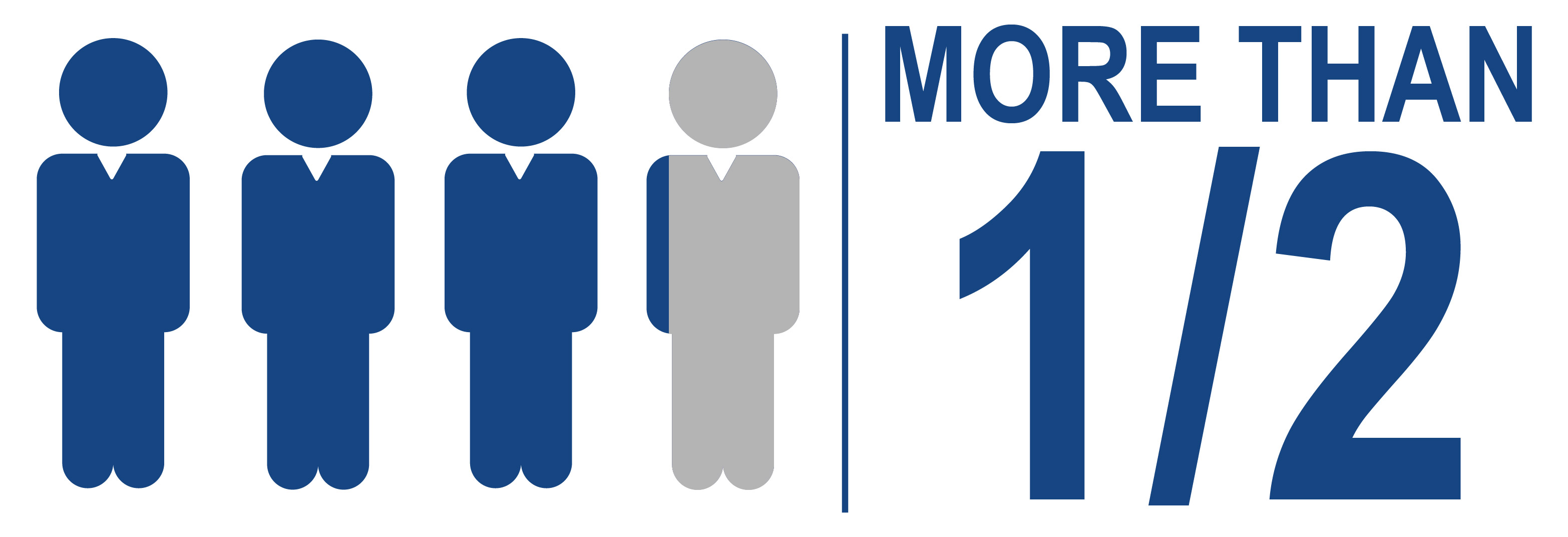

According to the State of America’s Workforce Study, a 2018 study of over 2,000 working Americans ages 40-70, when workers envision their retirement lifestyle, more than three-fourths want to travel and more than half plan to spend time with family, pursue hobbies and be active.

According to the State of America’s Workforce Study, a 2018 study of over 2,000 working Americans ages 40-70, when workers envision their retirement lifestyle, more than three-fourths want to travel and more than half plan to spend time with family, pursue hobbies and be active.

But, there’s also the issue of people making sure they have enough income to pay for their regular living costs. When it comes to these expenses, housing leads the retirement expense list, costing retirees approximately 34 percent of their average annual spending.

But, there’s also the issue of people making sure they have enough income to pay for their regular living costs. When it comes to these expenses, housing leads the retirement expense list, costing retirees approximately 34 percent of their average annual spending.

Planning for retirement income sources can help pay for anticipated costs in retirement, such as housing, transportation, and health care costs, as well as unexpected costs. Creating a nest egg that has guaranteed lifetime income, financial security and a balanced portfolio can help ease those long-term retirement concerns.

Guarantees based on the financial strength and claims paying ability of American Equity Investment Life Insurance Company of New York. American Equity of New York is a wholly owned subsidiary of American Equity Investment Life Insurance Company®.

American Equity of New York does not offer legal, investment, or tax advice. Please consult a qualified professional.